Taxes can be a major issue for the small business owner. If you are a one, these tax saving tips can be very useful to maximise your wealth.

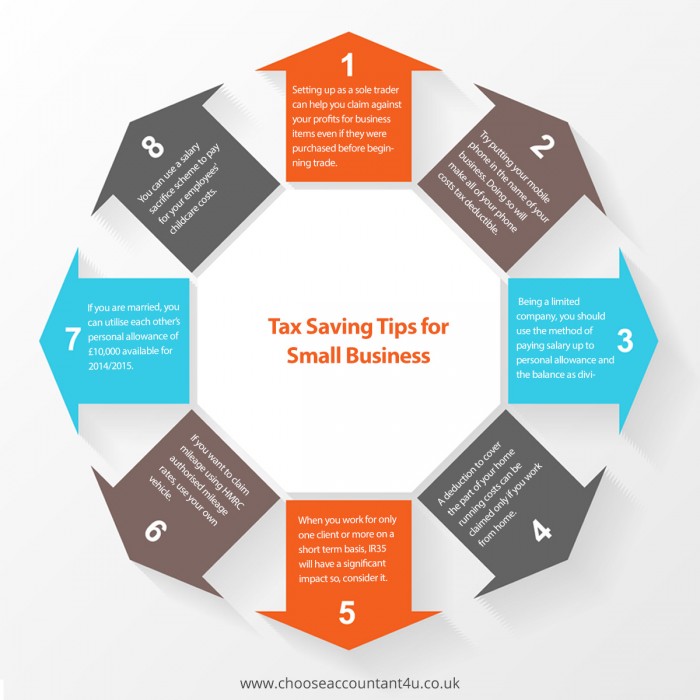

1. Setting up as a sole trader can help you claim against your profits for business items even if they were purchased before beginning trade.

2. Try putting your mobile phone in the name of your business. This will make all of your phone cost tax deductible.

3. Consider the method of paying for your business. Being a limited company, you should use the method of paying salary up to personal allowance and the balance as dividends.

4. If you want to claim mileage using HMRC authorised mileage rates, you need to use your own vehicle. In case if you own a limited company, using such rates can avoid tax charged on the company cars.

5. The Annual Investment allowance scheme provides 100% allowance up to 500,000 for 2 years from 5 April 2014. This means you need to plan your purchases to increase the relief where the accounting year end crosses the date.

6. A deduction to cover the part of your home running costs can be claimed only if you work from home. That is because HMRC allows £4 week flat rate without any evidence. However, if you think your costs are high, then you will be able to claim even higher.

7. If you are married, you can utilise each other’s personal allowance of £10,000 and lower rate tax bands of £31,865 which are both available for 2014/2015. Thus, transfer assets which produces income to your partner and take advantage of such lower taxable income.

8. Since pension contributions can be deductible expenses for the company and individuals are not required to pay tax on the benefit of having company pay them, you need to make contributions into a pension scheme.

9. When you have many employees, you need to take care of their childcare costs. This is where you can use a salary sacrifice scheme to pay for such type of cost.

10. When you work for only one client or more on a short term basis, IR35 will have a significant impact so you need to consider it.

These tips can help you save some amount of the tax. So, consider reading all of these points carefully.