The threshold for registration is the amount you make in a calendar year, which is calculated on the date you reached that threshold. This threshold is usually £85,000 or more. If your business exceeds this

Property Developer

The threshold for registration is the amount you make in a calendar year, which is calculated on the date you reached that threshold. This threshold is usually £85,000 or more. If your business exceeds this

Is your business still solvent and ready for the challenges ahead? We are helping business plan for the future, with the cash flow, business loans and insolvency where needed. Using a Creditors Voluntary Arrangement (CVA),

We are here to help support business with company debts, and helping with cash flow. Below is support from the UK government, we have summarised to make it easier to see your options;

Getting old is inevitable. And, in order to lead a secure life in your old age, choosing a right plan is very essential. One of the best options to stay secure in your old age

Although UK house prices went up again last month, the increase seems to be “predominantly flat” Russell Galley said that the prices of home have barely changed since March, keeping an average cost of homes

In the world of property, if you own your home you can pass it on to your husband/wife when you die without paying any inheritance tax. If you are unmarried or want to give your

If you are wondering how much it will cost to buy a new home or flat, there are a number of fees your will need to consider. Below are some short descriptions of what each

HMRX clawed back £108 million – £34,704 extra tax per case. HMRC has increased the amount of extra tax it brings in through challenged to the valuation of estates for Inheritance Tax purposes by 23%

You can claim capital allowances when you buy assets that you keep to use in your business, for example on equipment, machinery and business vehicles. We help commercial property owners claim capital allowances. If your

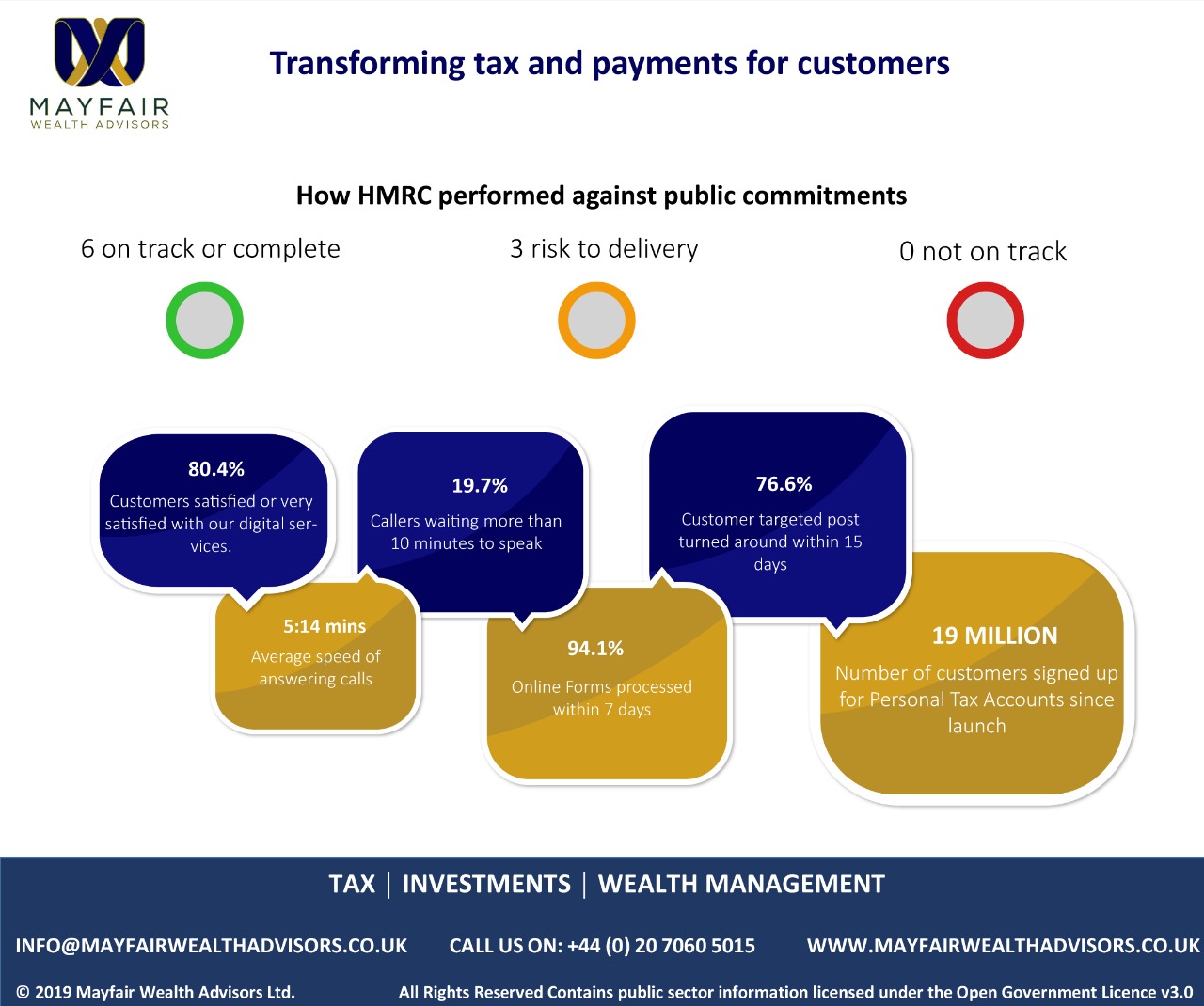

HMRC are the UK’s tax, payments and customs authrority. The money they collect pays for the UK’s public services i.e the NHS, schools, emergency services etc. It also helps individuals and families with fincancial support.

An increase in public sector workers pay will rise above the UK’s 2% inflation rate, thanks to Chancellor Philip Hammond. The deals will affect almost one million public sector workers: Teachers will get a 2.75%

Self Assessment is a system used by the HM Revenue and Customs’ (HMRC) for collecting Income Tax. Taxes should be paid to H M Revenue & Customs (HMRC) on the two set dates. They are