Have you heard about Real Time Information? Do you know why was it introduced? Well, it was the HM Revenue & Customs (HMRC) who introduced the RTI in 2013 with the view to improve the operation of PAYE.

Since its introduction, RTI has been considered as the most significant change to payroll in over the 70 years. While businesses were required to report PAYE information to HMRC in an annual basis before, now they should submit this information electronically “on or before” each payroll run. If the small companies with less than 50 employees fail to report payroll information on time, automatic penalties will incurred to them by HMRC.

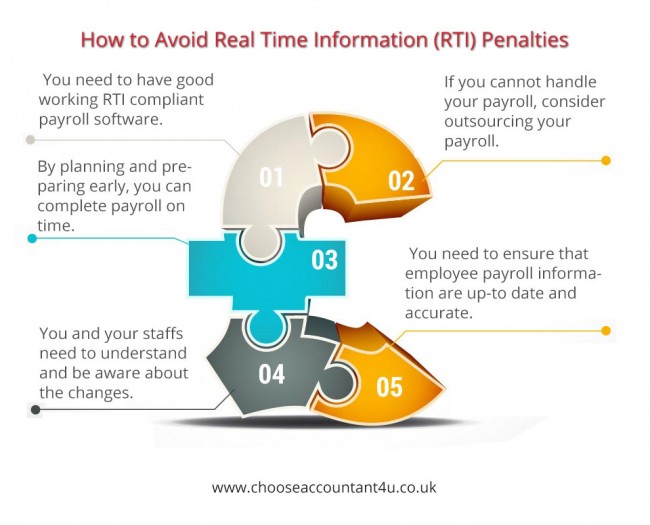

Whatever your business is, you need to protect it from penalties that can be incurred if you are not careful enough. Here are pointers to keep in mind for avoiding RTI penalties.

1) Have good working RTI compliant payroll software If you run payroll within your organisation, you must have good working RTI compliant payroll software. Not only your software should be compliant, but should also suit to your specific business requirements. With plenty of payroll options available today, you can choose the solution that can handle your requirements by taking size and complexity of your payroll into account.

2) Outsource your payroll if you cannot handle it If you cannot handle your payroll, consider outsourcing your payroll. However, you need to ask certain questions to your providers first before outsourcing. You can also provide them with the figures you want to pay your employees. But, most importantly, you need to ensure they are RTI compliant.

3) Keep up to date and accurate data You need to ensure that employee payroll information are up-to date and accurate. This helps you to make easier transition to RTI reporting and thus avoid any financial penalties. If there is a variation between HMRC and your actual records, it can result in wrong tax codes which lead to you to pay a wrong amount of tax.

4) Be aware about changes You and your staffs need to understand and be aware about the changes. It is because these changes will have a significant effect on your business. Training courses with free guides can be provided to your employees to help them understand about the legislation and compliance.

5) Plan and prepare early Planning and preparing early, you need to dedicate a specific time of daily schedule for completing your payroll on time. This can also help you switch to complete RTI reporting in a very relaxed manner.

In order to avoid RTI penalties in the future, do make sure learn all these tips. If you want any help regarding this matter, fill a simple form and get the suitable accountant.