HMRC are the UK’s tax, payments and customs authrority. The money they collect pays for the UK’s public services i.e the NHS, schools, emergency services etc. It also helps individuals and families with fincancial support. HMRC are the organsisation who prevent criminals and those trying to avoid tax come to light through their tax system.

Contractors and freelancers update HMRC yearly when filng tax returns and their general finances. If said information is believed to be wrong or misinterperating by HMRC then they have the right to investigate it with an officer. Although they can investigate any suspcious aspect with warning, you can refuse if no prior warning is given.

The main purpose of HM Revenue & Customs is to help everyone get their taxes right, and in turn, fund things that affect everyone in the UK. For example: schools, hospitals, roads etc. They’re focused on playing the part in building a healthy tax system. One in which reduces the tax gap, makes it easy for customers to pay their taxes or claim any entitlements, keeps financial and time costs to a minimum and tackles those who try to cheat the system. It must be trusted and seen to be fair, with the right safeguards in place to protect customers.

In order for HMRC to deliver on their vital purposes, there are three objectives that guide everything they do:

- Collecting revenues due and bearing down on avoidance and evasion

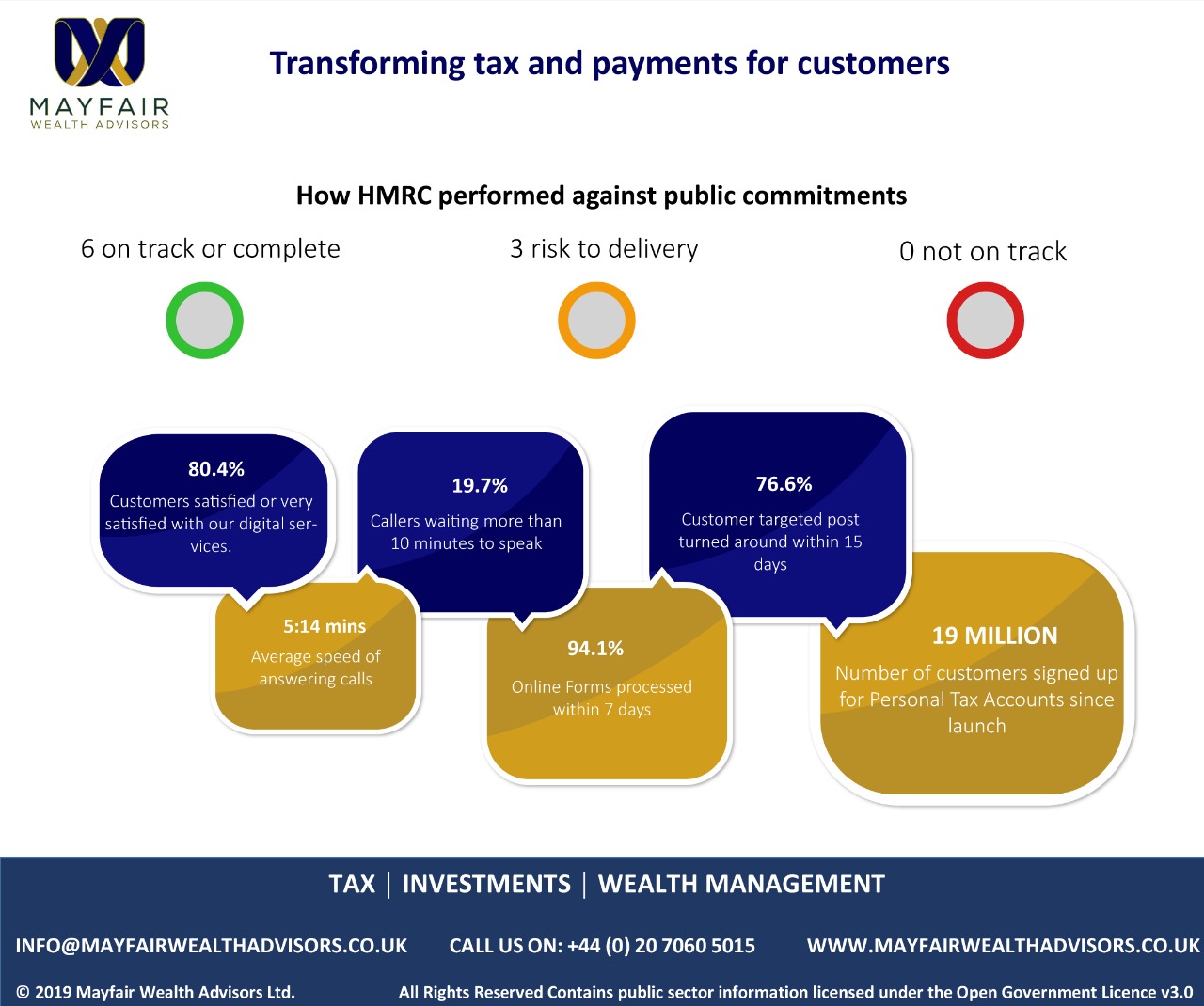

- Transforming tax and payments for customers

- Designing and delivering a professional, efficient and engaged organisation

If you do find yourself involved with HMRC or any of its officers then it could be wise to seek advice from us at Mayfair Wealth Advisors where our specialists can advise you every step of the way.

Contains public sector information licensed under the Open Government Licence v3.0.